Americans are changing the way they shop, and these new habits are driving growth. In 2013, U.S. retail sales totaled $4.5 trillion, growing at a meager 4 percent. In contrast, e-commerce within retail totaled $263 billion, growing at 17 percent. Customer behavior is likely to continue to change, given innovation in retail and low e-commerce penetration (less than 6 percent of total retail). When considering that mobile commerce is growing at 75 percent, it becomes clear that the future will look very different from the present. The best is yet to come.

Of course, online brands have benefited the most from this change in consumer habits, while sales for established retailers, such as Best Buy or J. C. Penney, have declined or remained flat at best. Brick-and-mortar retailers are taking the brunt of the damage. But not all online retail brands have benefited in the same way. Some, such as Amazon, have flourished, while others, like RedEnvelope, have either sputtered or remain niche brands.

We wanted to look more closely at the success of online retail as a whole. Are there any patterns that explain how new entrants have built stronger brands over time? How do powerful online retail brands like Amazon stand out from the pack?

Amazon on top

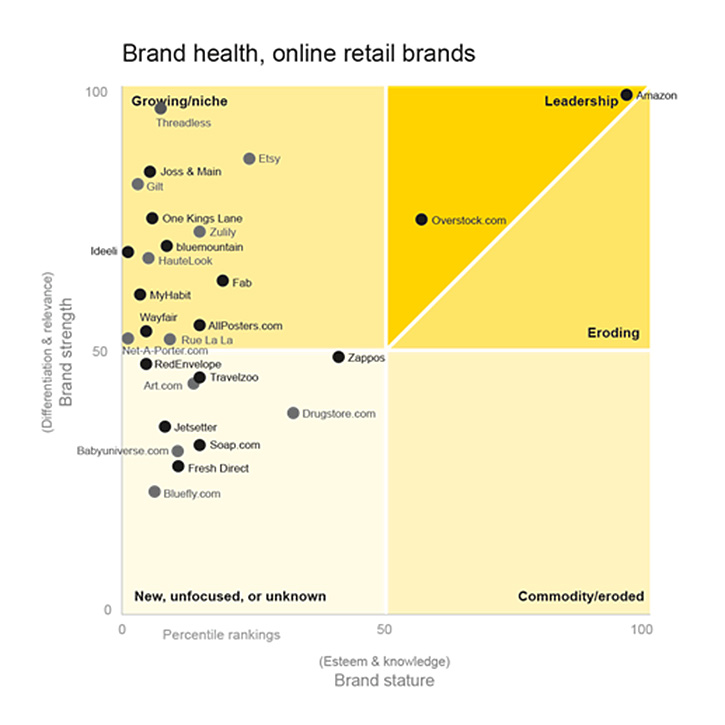

Amazon’s very strong brand stature and strength give it an unparalleled leadership position among online retail brands.

We conducted quantitative research on 27 online retail brands using BrandAsset® Valuator (BAV) data (see sidebar). Our sample was varied and included large and small brands, brands with wide and narrow product assortments, and both value and premium brands. We assessed the imagery of each brand across 48 personality and image attributes. We then ran a regression to understand drivers of customer behavior and to compare them to brand perceptions. The findings should help inform brand strategy for players in the space.

Online retail brands must be not only different, but also relevant

Amazon has done many things right to become one of the strongest brands in online retail. At its inception, Amazon established itself as a different option to classic retailers. This gave it momentum with customers.

But Amazon did not stop at being different. It worked diligently to exponentially increase its relevance with customers through an expanded set of offerings and distribution options. Originally limited to books, Amazon expanded its product portfolio to include everything from gardening supplies to web services; it recently launched Fire, its first smartphone. “From the company perspective, given that their hardware devices make it so easy to purchase content, here’s a brilliant new delivery mechanism that will give Amazon yet another dimension into its already virtually 360-degree view of its customers’ behaviors,” wrote retail expert Robin Lewis.

We see many online brands positioning themselves based on being different. The basis of differentiation varies: some offer an alternative to established players, some a different customer experience, others different pricing models. However, based on Amazon’s successful journey, being different is not enough. To become a strong, powerful brand, online retail brands need to build greater relevance with customers. Amazon would not have become such a strong brand if it had offered only books and a single delivery model. The explosive growth of Amazon Prime membership is a testament to this.

In the quest for difference, online retail brands are telling an undifferentiated story

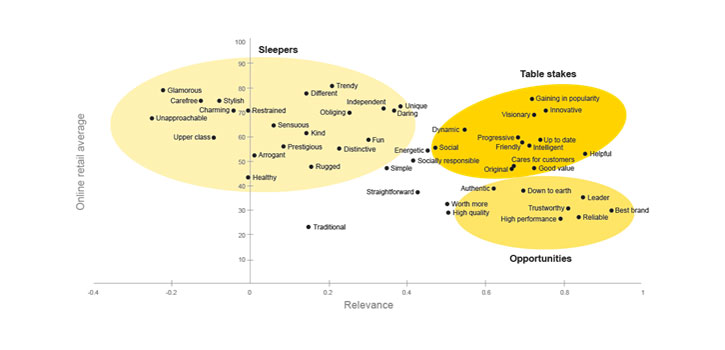

We ran a regression to identify the brand attributes that are most important to driving relevance, and then compared them to those that are commonly used today. We found that these attributes fell into one of three camps: Sleepers, table stakes, and opportunities.

Online retail brand attributes

Brands suffering from a lack of relevance and differentiation should consider adopting table stakes and opportunities attributes.

Sleepers are those attributes that are very common in the mind of customers, but have little impact on driving relevance. These attributes are common to almost all brands in our sample and emphasize how much these brands are different (that is, independent, unique, distinctive); how much they are fashionable or trendy (stylish, glamorous); and how exclusively they present themselves to the market (unapproachable, upper class, arrogant).

Most brands in our sample, with the exception of everyday staple brands such as Fresh Direct and Drugstore.com, over-index in these attributes. Brands that rely on a positioning focused on these attributes are not only getting lost from a differentiation perspective, but also are not evolving into a more relevant brand.

Table stakes are those attributes that are both common in the mind of customers and important in driving relevance. Failing to deliver on these attributes puts brands at a disadvantage. What is interesting about these attributes is that they communicate how cutting edge a brand is (that is, innovative, visionary progressive) and how much the brand cares for its customers (cares for customers, helpful, friendly). Brands such as RedEnvelope and Bluefly.com under-index in these attributes and should consider delivering on core customer expectations to support their journey.

To drive differentiation and relevance, become a more trusted and true brand

Opportunities are those attributes that are least common in the mind of customers but highly important in driving relevance. These attributes evolve the brand conversation into a more trusted (that is, reliable, best brand), true (original, authentic, down to earth), and value-focused (worth more, high quality) territory.

Of all 27 brands in our sample, only Amazon performed strongly on these attributes. No other brand in our sample comes close to Amazon on key perceptions such as helpful, leader, reliable, trustworthy, down-to-earth, high quality, and worth more.

The path forward

Online retail brands need to figure out where they are in their own journey. Being different by itself is not enough. Generating relevance with a broad customer base is critical to fuel growth. Data suggests that driving relevance requires a shift in how brands position themselves. It requires an evolution from being just different, exclusive, and trendy, into being trusted and true to customers. It requires demonstrating the value that they bring and pushing the brand beyond the initial positioning that made them successful.

Photo: Thomas Leuthard / Flickr