There have been many voices talking about the effects of the coronavirus on ourselves, our brands, and our world. Some of them were mere opinions, based on intuition, while others looked into the past for how communities reacted to different crises. It’s fine to know about different (possible) scenarios and see what other brand experts think of as ‘probable’, but what does data have to say about it? What do consumers actually feel, think, and do, and how have the changes brought about by the pandemic influenced their behavior?

A fair amount of time has passed since we first encountered the virus, and it’s safe to say that some of the social changes enforced and self-enforced as a response to the pandemic are starting to be felt more and more at the commercial level — a butterfly effect, if you will. Small decisions, at an individual level, have induced strong behavioral shifts in communities around the world.

To find out more about how different consumer groups reacted to the pandemic, what are their behavioral shifts, and what is their impact on branding and communications, Brandingmag sat down with Martijn Lampert, Co-Founder and Research Director, and Martin Schiere, Principal, Marketing Strategy Lead at Glocalities. With the help of Dynata, the Glocalities leadership team conducted a global survey on the effects and trends brought about by the COVID-19 virus, sampling over 4,000 consumers from 6 different countries and merging everything in a trends report with some unexpected findings.

In this interview, Martin and Martijn talk about the importance of their findings and some other exclusive insights:

Brandingmag: How representative is the sampled audience for the global market?

Martijn Lampert: The survey was carried on 4,271 consumers across 6 different markets, from April 22 to May 12. These same respondents were interviewed at the beginning of 2020 in our annual global Glocalities survey, so we were in a unique position to track trends. These are the sample sizes: Brazil (n=524), Italy (n=525), Netherlands (n=1,056), South Korea (n=526), UK (n=906), and USA (n=734). These sample sizes are sufficient for tracking trends. Of course, these samples are not representative of the entire world.

For a recontact study, this is a relatively large sample and statistically significant for all 6 markets surveyed. As a technical note: Statistical significance is related to the sample size and variation within the population you are sampling, it is not related to the size of the population you are sampling. Cell sizes of 100 are already large enough (depending on the variance).

Furthermore, the data is statistically weighted according to age, education, gender, and region. This is a statistical technique to make the data representative at a national level for each market.

Bm: Can the whole world relate to the findings or are there only certain countries (with similar markets) that can relate?

M. Lampert: Naturally, these 6 countries are not representative of the entire world. In all 6 markets, which are on 4 different continents, we saw shifts and trends due to the COVID-19 crisis and due to the nature of these trends, it is likely that similar shifts have taken place in other markets that have been affected by the pandemic as well but to different extents.

By looking at international trends, we find some mechanisms that confirm theories about the effects of pandemics on values and psychology. And these theories enable us to generalize the findings to an even larger extent. However, there are also differences between markets. For instance, in the US and Brazil, where people have the least trust in the truthfulness of government communications about the pandemic. Initially, in these markets, the government leaders have not taken the pandemic seriously and it’s now out of control — as the growing cases show. In the other 4 countries from the study, the authorities have been able to flatten the curve, so the rise of trust in government is huge.

At the same time, the differences within markets are just as interesting as between markets. More explorative consumers or target audiences (‘’Challengers’’ and ‘’Creatives’’) are most affected in their world views. And our previous research has shown that these more explorative consumer groups are also present in almost all markets — not only in the 6 markets we researched.

Bm: Given that the sampled percentage is extremely small compared to the total population of those markets, is it possible that there are other, undiscovered behaviors that could derail the trends uncovered by the report?

M. Lampert: This is highly unlikely as all of our identified trends are measured at a statistical significance level of 0.95 percent. This means that there is a 5% chance that the trends we describe are not significant.

As mentioned earlier in the technical note — for a recontact survey — the sample size is pretty big and the size of the population to be sampled is not relevant to the significance. Through the recontact survey, we were able to track trends at an individual level, so the differences cannot be attributed to sampling errors and the reliability of the trends is high.

What is possible is that some trends might become more pronounced in markets where the pandemic is still ravaging society. For instance, in the Americas, where the focus on community spirit might further develop. At the same time, the findings are in line with what the ‘parasite-stress theory’ predicts. So, on top of the statistical significance, we are able to interpret the reactions to the pandemic in light of academic research from various disciplines.

Bm: What are people afraid of, when it comes to the effects of the pandemic? Can you share a few points on what they are most and least worried about?

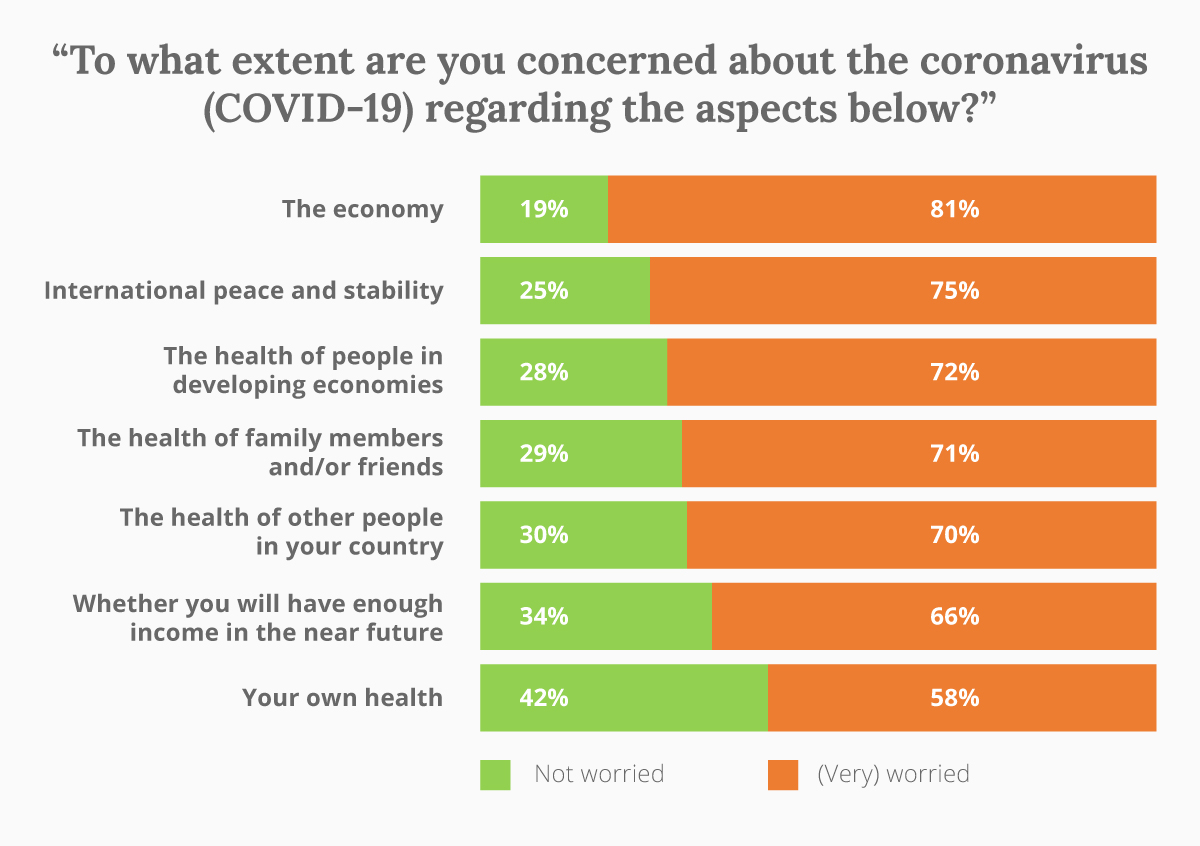

Martin Schiere: Worries about the economy affect most consumers (81%), followed by worries about international stability and worries about the health of others. Surprisingly, worries about one’s own health scores only seventh, with 58% of consumers stating this as a concern.

Also here, as mentioned before, there are quite some differences between different target audiences. For example, Creatives — open-minded idealists who adhere to self-development and culture — are more worried about the health of people in (other) developing economies.

Bm: What is the new focus for consumers? What are they more interested in now and how has this new focus altered their behaviors and, more importantly, their values?

M. Schiere: Good question. It’s not so much a new focus as a shift in focus. Or better yet, a shift in attitudes.

Consumers did not become different beasts all of a sudden. By and large, most attitudes and values did not change, however, some attitudes and values did. We identified 5 main trends or shifts:

Back to Basics

In general, consumers have become more inward-looking and want to serve their basic needs first before indulging. They have also become more risk-averse and are hesitant to make long-term plans due to the uncertainties that come with a crisis.

Small World

On average, people are less open to the globalized world and towards people with other philosophies of life. The level of trust in the distant “other” has gone down. For instance, trust in international organizations and multinationals has decreased. This can have significant implications for international brands that focus on their cosmopolitan or international heritage. It should be noted, however, that due to this trend, we expect a counter-reaction from more cosmopolitan target audiences that feel threatened in their open and tolerant world view.

Truthfulness

Truthfulness (in science and education) has made a come-back. In their quest for more security and trustworthy information, consumers demand truthfulness in communications from governments and brands alike. This also implies that consumers are becoming more critical about how brands communicate.

Here and Now

In the eye of the storm of a crisis, people are on high alert and increasingly live in the moment. People dream and fantasize less. For some consumer groups, this also means fewer long-term goals and more instant gratification. It is no coincidence that more people currently agree with the view that buying something new is one of the joyful things in life.

Community Spirit Has Increased

Consumers feel more involved with the community they live in and increasingly aspire to work for an organization that also pursues social goals. Purpose and contributing to society are becoming increasingly important for brands. Consumers also have a greater interest in politics, as political decisions are having an immediate effect on their daily reality and prospects. Brands that associate themselves with togetherness and being part of a wider community have a greater chance of resonating with consumers during these challenging times.

Thus, to conclude, consumers did not all of the sudden become different beasts, but some things have changed due to the impact of the pandemic. As long as we live in uncertain times and all signs are on alert that the world is now entering an economic crisis next to a health crisis, we expect these changes to last.

Bm: Glocalities works on top of its own set of consumer groups, effectively highlighting representative typologies. How different are the reactions of each group to the pandemic and its effects? Which ones are most affected?

M. Schiere: Actually, it’s the other way around. As part of the Glocalities research program, we ask and monitor hundreds of values, attitude, lifestyle, and behavioral questions, including brand usage. This is the basis for our data and insights.

And based on that data, we build our own values segmentation — as an additional analysis tool. We have been building values- and lifestyle-based segmentation in the Netherlands for more than 25 years and international segmentation based on our Glocalities data for more than 6 years. We believe it is the best values-segmentation standard, as both the quantity and coverage of countries globally as well as the quality of the values data is unique.

With this segmentation, we can quickly compare the social-cultural structure of markets, cultures, and consumer profiles of brands — and how different consumer groups with different value sets experience and react to the virus.

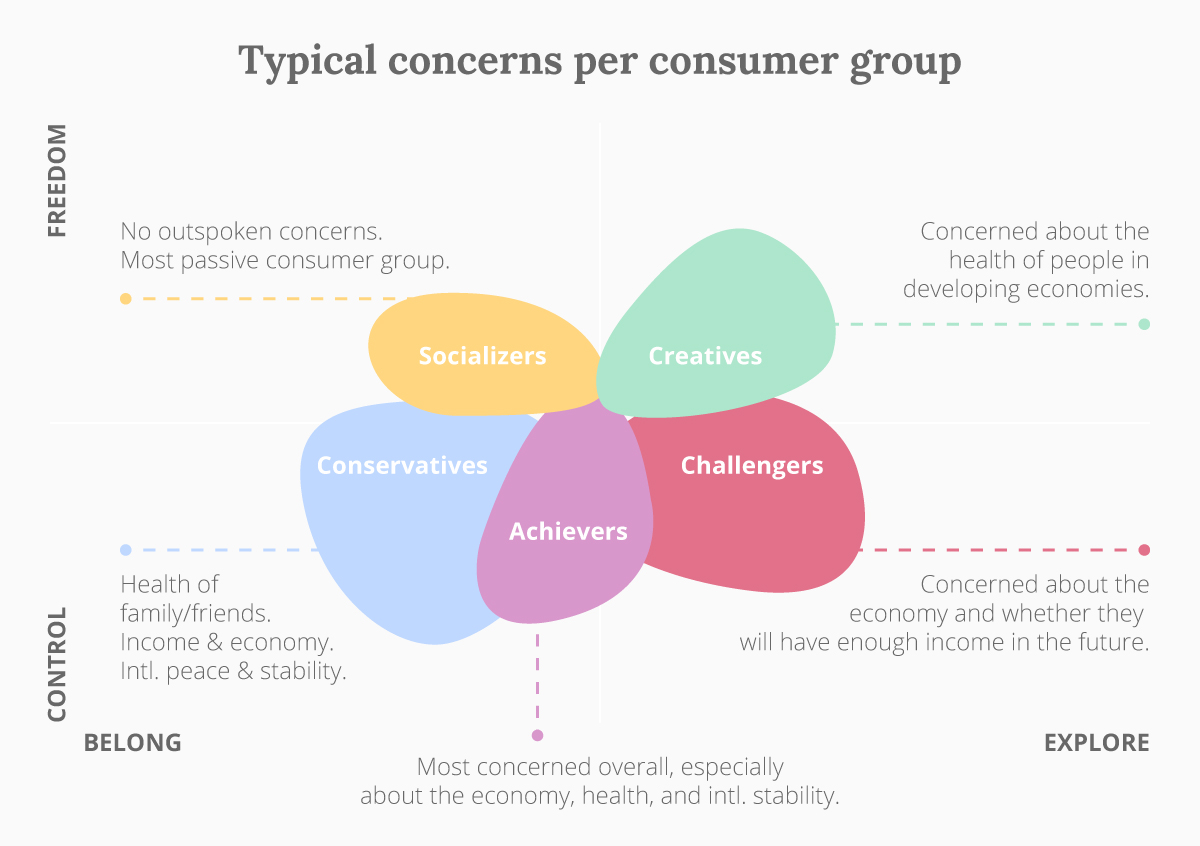

For example, Achievers, entrepreneurial networkers who focus on family and community life, are the most concerned about the COVID-19 crisis in general, and they are especially concerned about the economy, health, and international stability.

Socializers, sociability seekers who love entertainment, freedom, and family value, are concerned on one hand but also pretty passive on the other, in the sense that they protest less and are less activist.

Challengers, competitive careerists, fascinated by money, taking risks, and adventure, see their ambition to get ahead and their desire for fun and adventure the most curtailed — this group also protests the most. However, their values and attitude set hardly changed.

Bm: What about similarities? Do the groups share any common denominators that still hold the social bonds and inhibit the raw survival instinct?

M. Lampert: Yes, actually. The values of friendship, family, and health — the big things are the common denominator for all groups, and almost all of humanity scores surprisingly high on them. This is not only across our Glocalities groups but also across cultures and religions. We actually published a report on the universality of values across religions and among non-religious groups a few years ago. These values are universal and what makes us human — what binds us. However, when we are under stress, we are less oriented towards self-actualization and higher values, and focus more on survival values, protection, and security.

Bm: Speaking of instincts, you mentioned that some of the report’s findings confirm the ‘parasite-stress theory’, developed by Corey Fincher and Randy Thornhill, which states that diseases shape the development of a species’ values. What brought you to this conclusion and how is the theory being seen in the real world?

M. Lampert: This report about the impact on branding and communications is actually the second report in a series of three. In the first report, we describe that the vulnerability to an infectious disease is linked with collectivist attitudes. Throughout human history, when there is a risk of infections due to parasites or viruses, people and communities tend to keep outsiders at bay and focus on the in-groups foremost. Because outsiders may be a threat to the health of your community. This is a natural reaction, with communities turning inward.

Now, you see this with closed borders, drastically diminished air travel, lockdowns, and the popularity of holidays in your own country instead of abroad. This is a prominent trend that we see in our study. People put less faith in international organizations and there is a steep rise in trust in the national government. People are less open towards people with different belief systems and less focused on international solidarity and equality. Community spirit is on the rise.

These trends will stay around for quite a while and are relevant because many brands (and also their strategists and creative advisors) like to play with a cosmopolitan lifestyle, tolerance, and openness as values. This trend is highly relevant to positioning brands. This is a new context that will remain for some time.

It is important to understand and tap into regional and local cultures and differences when you want to keep on growing among the mainstream segments in the population. Alternatively, you can focus on open-minded and cosmopolitan consumers, but their context has changed a lot. Many of them are becoming more activist and demand from brands to take a stance. It is pivotal for brands to understand these new dynamics and how these affect their audiences in specific countries. Gut feeling is no longer sufficient in these times of crisis. Keeping the trust of consumers and fulfilling their need for security and recognition is important, and mistakes are easily made.

Bm: Just like the parasite-stress theory, are there any other findings that did not make it in the report, but might prove interesting to brand leaders?

M. Schiere: As a hypothesis, it seems that, overall, we have become a bit more activistic — socializers are less passive than they were (although still the most passive group).

Last but not least, we are looking into the effect these trends have on ‘brand liking’ — we are getting the impression that brands that focus more on the communal spirit and stand for what they believe in, in a truthful and believable manner, are in the ascendency — at least we can say that they are on-trend.

Bm: Brands have been doing all sorts of things with their communications, reacting more or less appropriately to the global crisis. There has been both applause and call outs, but you chose to feature the case of Gucci in the report. Can you please describe the danger that Gucci was not aware of and the consequences of its (over) reaction?

M. Schiere: We focused on Gucci because we believe that the danger of overshooting and thinking that “everything has changed” is just as big as thinking “everything will soon go back to how it was, we don’t have to do anything — nothing has actually changed.”

And there are also quite a few good cases of great-adapted branding and communication (i.e., Heineken, Barilla).

We often see that communication errors are made when brands don’t look carefully at who their target audiences are and what they want. Just latching onto trends, assuming that they are also relevant for your target audience, is not enough. Trends might affect your target audience, or they might not. Or, in the case of Gucci, in a different manner than you think.

As a reaction to the current coronavirus crisis, Gucci launched a new “Conscious Living” creative approach, and launched its first sustainable line. In a similar vein, actress Emma Watson, a well-known supporter of eco-friendly fashion, just joined the board of Gucci owner, Kering.

However, this radical turn is not in line with the Gucci consumer. Gucci is a typical brand appealing to Challengers and Achievers. Gucci customers like to stand out and they are eager to adopt new concepts and products. At the same time, they are very ambitious and like to enjoy life as well. However, Gucci consumers tend to care less about environmental sustainability.

During the current crisis, Gucci’s customers are among the consumers who are most frustrated by the effects — they experience that their freedom to realize their potential is being threatened. Still, their key values and attitudes towards life have been impacted to a smaller extent: They have not changed and certainly not in the “Conscious Living and sustainable new direction of Gucci.

Gucci risks alienating its current customer base, while not yet being credible and rooted enough to attract more creative-oriented target audiences. A classic over-reaction and jumping-on-a-trend (sustainability and conscious living) without actually analyzing to what extent it is applicable for your target audience.

Based on the data and insights we have on the Gucci consumer — particularly in relationship to COVID-19, Gucci would do well not to change its winning formula — focus on the Achievers and Challengers, focus on the values that are relatively important for this Gucci consumers: beauty, wealth, ambition, recognition, and status.

In addition, if Gucci really wants to follow this path, to make a success out of its “Conscious Living” approach and add more purpose into the Gucci brand, it should focus on the issues that the Gucci consumers care more about: human rights, protection of refugees, sexual rights, and gender equality.

Last but not least, Gucci can work more with African American, African, and Asian artists — both on the design front and in communications. Hip-hop and especially K-pop score high as favorite music genres amongst Gucci consumers. The brand should expand its very well-chosen cooperation with Lil Nas X, start working with edgy, cosmopolitan Asian music bands, and even look into country music (Gucci consumers seem to have a predisposition for it).

Bm: What are some recommendations for brands, their strategies, and their communications, both now and after the pandemic has been long gone?

M. Schiere: First of all, it looks like the effects of both the coronavirus and the subsequent economic recession are here to stay for a while. And the shifts we have detected in attitudes — and to a certain extent in values — will only recede slowly and after a prolonged period of stability.

Pandemics and recessions are traumatic events whose effects can last a lifetime. Based on our COVID-19 findings and other brand and communication research, our recommendations are:

- Be more emphatic, more emotional. Focus on the national and local context, and on the communal values of your target audience. Many brands (i.e., Heineken, Barilla) did this very well in the first communication they aired in the first month of the lockdown.

- Also, be truthful and authentic — consumers have become more critical and wary of numbers and facts.

- And to the extent that is applicable, focus more on giving your brand an additional purpose except selling products. This, however, has to be truthful, credible, and in line with the values, attitudes, and charitable orientations of the consumer groups. Focusing more on (a higher) purpose is not for all target audiences and not for all brands — as the Gucci case shows. Furthermore, different target audiences have different issues and causes they are more passionate about than others.

Cover image source: Max Bender